Milwaukee County leaders were hoping to ask voters in April to increase the local sales tax by 1 percent in exchange for property tax relief.

Democratic lawmakers introduced a bill last fall that would allow Milwaukee County municipalities to put a binding referendum on their ballots asking for the increase. But the bill is stalled and did not meet the deadline to be put on the April 7 ballot.

State Rep. Evan Goyke, D-Milwaukee, who co-sponsored the legislation, said he’s hopeful there will be a sales tax referendum in November.

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

“If it were to pass this session, I believe it could appear on the November ballot,” Goyke said, adding he’s hopeful there will be a public hearing this spring.

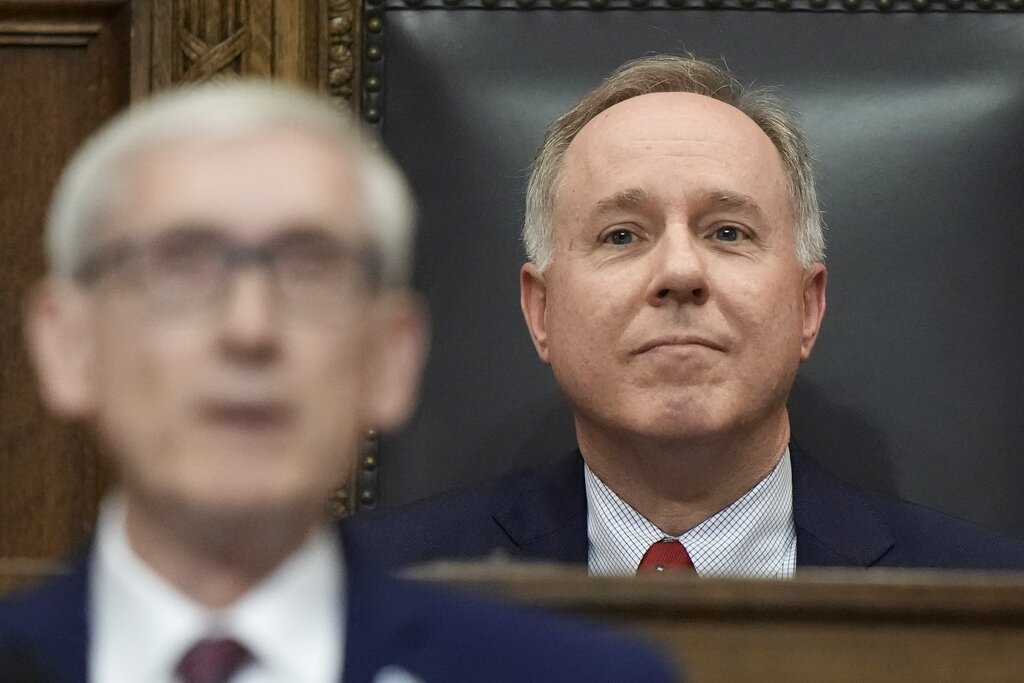

Assembly Speaker Robin Vos, R-Rochester, has said the Assembly will finish in February. Senate Majority Leader Scott Fitz, R-Juneau, has said the Senate will finish in March.

“I can tell you that there are a number of groups who believe this is important,” Goyke said. “Communities around the state are watching what’s happening. They are educating their lawmakers. Milwaukee is the barometer. Local governments have the same constraints and the same issues local governments has.”

Municipalities can not increase a tax or go to referendum to do so without approval from the state. Gaining approval from the Republican-controlled Legislature could be an uphill battle. According to the Wisconsin Policy Forum, Wisconsin ranks seventh in the nation and first in the Midwest for its reliance on property taxes for funding municipalities.

Under the proposed bill, Milwaukee County could ask voters to approve a 1 percent sales tax increase with a referendum. The bill requires 25 percent of the revenue from the additional tax be used to provide residential property tax relief, divided evenly between county and municipal property.

Seven percent of the revenue must be used for public health infrastructure projects and the remaining 68 percent of the revenue has to be used for operational and capital expenses in the county and municipalities.

Milwaukee County officials launched the Fair Deal Workgroup in 2018 to explore new revenue options to address the structural deficit. The proposal to raising the sales tax was widely praised in Milwaukee County by Democrats, Republicans and local business organizations.

Goyke said asking voters to support the increase in April would have been ideal because the Democratic National Convention will be in Milwaukee in July — bringing a major influx of spending to Milwaukee County.

“It would have been really important for local governments to realize a major piece of that spending,” Goyke said. “However, Milwaukee and Milwaukee County will remain the cultural and entertainment hub of Southeastern Wisconsin, beyond the DNC. We will have Summerfest, we will have the Bucks, we will have the Brewers. We still need the legislation and the revenue.”

Milwaukee County supervisors could have put a nonbinding referendum on their April ballot, but it would not have counted.

Milwaukee Mayor Tom Barrett said without the sales tax increase this spring, he will be unable to restore 60 Milwaukee Police officer positions that were cut in the 2020 city budget.

Barrett said the money would have also been used to purchase an emergency vehicle for the fire department, road paving and for lead remediation.

“The need is still there, it’s a tremendous, tremendous need and it’s not going to go away,” Barrett said. “Anybody, and everybody who has looked at this in a serious way recognizes how much of a straitjacket the city is in right now. We need more flexibility and that’s why we are looking for this new partnership with the state.”

Wisconsin Public Radio, © Copyright 2026, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.