After a year of decline for Wisconsin’s frac sand mining industry marked by closures and bankruptcy, a national analyst expects more sluggish demand in 2020.

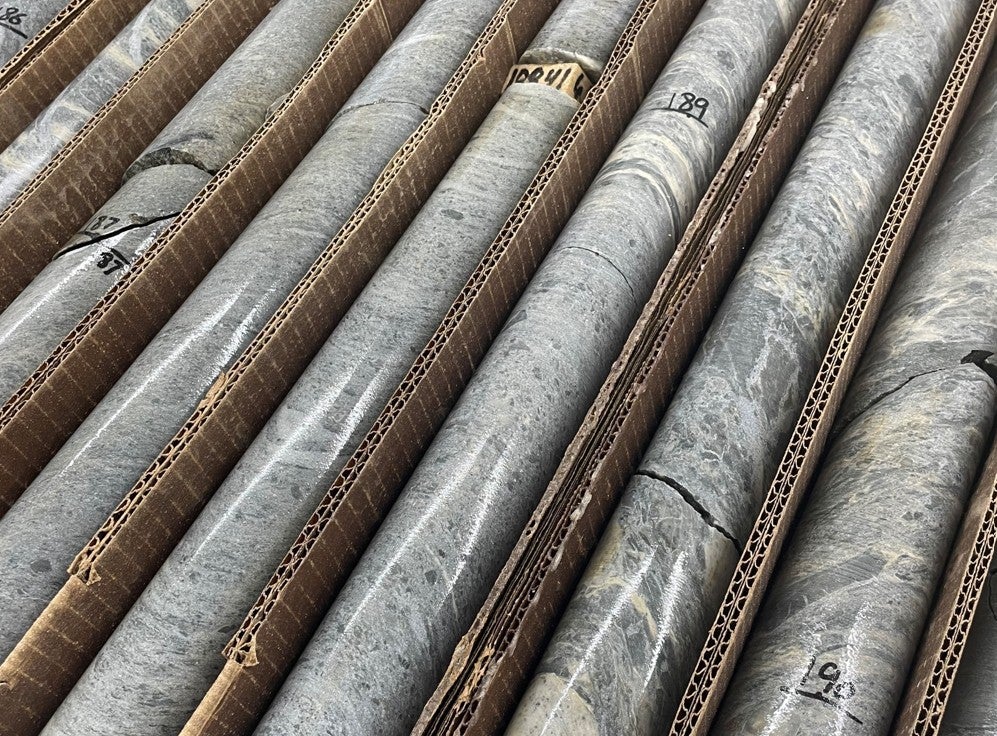

Over the last two years, the once prized silica sand mined in Wisconsin, known as “Northern White,” has fallen out of favor among a growing number of companies drilling for oil and natural gas in the nation’s busiest oilfields of west Texas.

The shift was about economics. Companies began using more sand from dunes nearby the Texas wells rather than paying as much as $50 to $60 per ton in additional fees to ship stronger, higher quality sand from Wisconsin.

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

In 2019, the preference for what is known as “in-basin” sand from Texas, combined with a slowdown in drilling activity nationwide, caused Wisconsin frac sand mines owned by companies like Hi-Crush Proppants, Covia and Superior Silica Sands to idle operations. In July, Superior Silica Sands parent company Emerge Energy Services filed for bankruptcy.

Looking forward to 2020, Thomas Jacob, Rystad Energy Director of Shale Research, said the picture for Wisconsin sand mining companies won’t get much better. He said his analytics firm expects drilling activity to decline by around 7 or 8 percent this year, with demand for all frac sand to be mostly flat compared with last year.

Jacob said over the past two years, some analysts have questioned whether companies drilling in what is called the Permian Basin of west Texas would see declines in oil production when using local sand because it’s not as strong as its counterpart from Wisconsin. The idea was the inferior sand would crush and clog oil wells.

“But so far in-basin sand has pretty much won the race,” said Jacob. “We think adoption rates for in-basin sand in the Permian is around 85 percent and we expect it to stay that way.”

Jacob said there are other oil and natural gas drilling operations using higher percentages of “Northern White” sand in places like North Dakota, Colorado and Pennsylvania but the loss of market share in Texas has forced Wisconsin’s sand mining industry to scale back.

“We’ve already seen a lot of capacity come out of Northern White sand,” Jacob said. “So, our number is around 45 million tons has come out of the market and what’s going to happen is the guys who are on the lower end of the cost curve, they survive.”

Jacob said it’s possible that another 10 to 15 million tons of Wisconsin frac sand mining production will go offline in 2020.

Wisconsin Public Radio, © Copyright 2026, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.