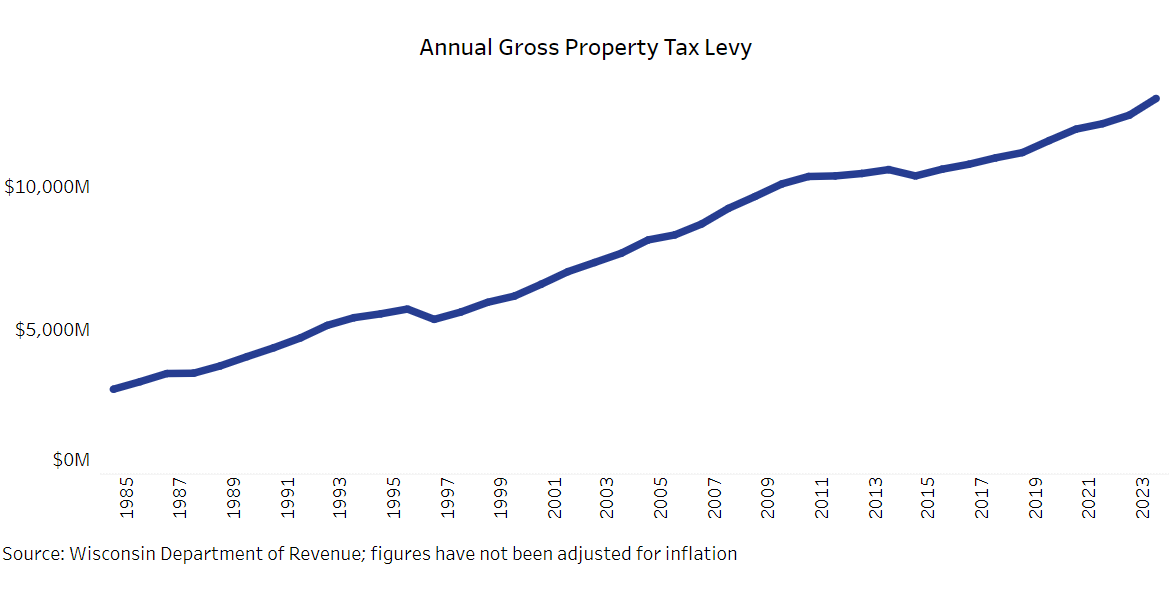

Total property tax levies approved by local governments across Wisconsin last year saw their largest increase since 2007, according to the Wisconsin Policy Forum.

Property tax levies increased by 4.6 percent statewide, almost double the previous year’s increase and exceeded the 4.1 percent inflation rate in 2023, according to the Policy Forum’s newest annual analysis of property taxes.

That comes after two years where the Policy Forum says inflation substantially outpaced statewide levy increases. Those property taxes were on residents’ December 2023 tax bills and are used to fund local governments this year.

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

“The biggest contributors to your property tax bill are first going to be your school district, and then typically, in most cases, your municipality,” said Mark Sommerhauser, communications director for the Wisconsin Policy Forum. “It does depend somewhat if you live in a city or a village versus a town.”

Sommerhauser added school districts are dealing with a lot of challenges when it comes to budgeting, especially because salaries for teachers and staff members need to be competitive to keep people in the field.

“Many school districts have found themselves in a very competitive labor environment for teaching workers and for staffers,” he said. “Inflation has been a big driver of that, especially in the prior two years.”

The Wisconsin Policy Forum released its updated 2024 Property Values and Taxes Data Tool on Thursday, which includes information on all the state’s counties, municipalities and school districts.

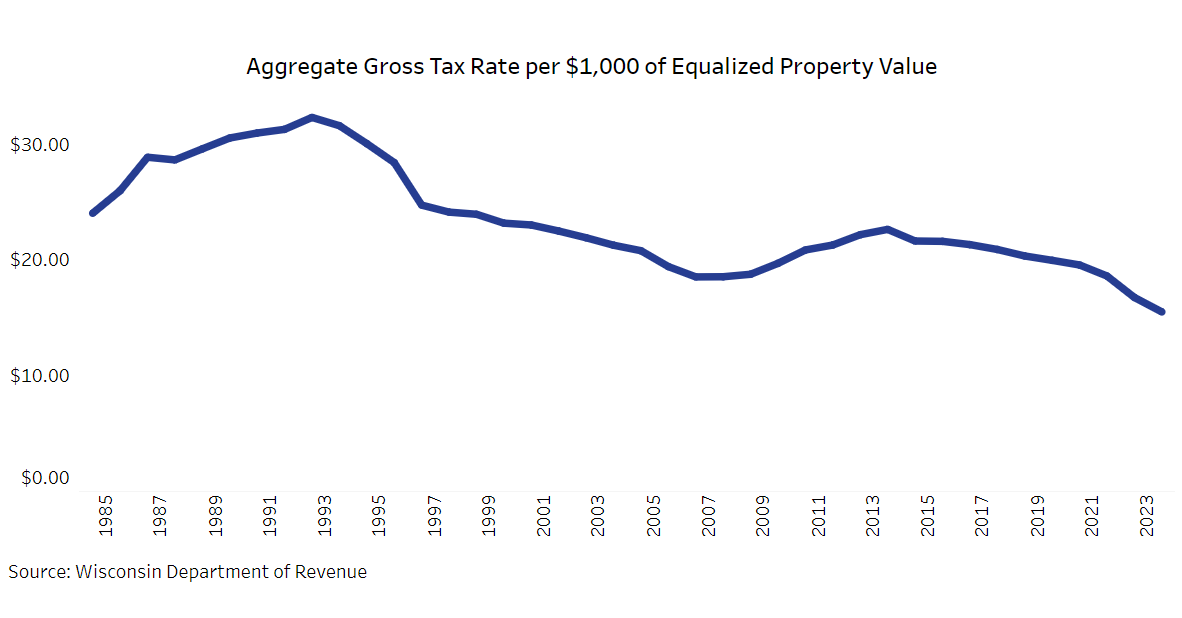

While gross tax levies have risen statewide, equalized property values increased by 7.7 percent in 2024, slowing down from the previous two years but still exceeding the annual growth rate in property tax levies, the Policy Forum’s data shows.

That growth in property value has caused a decline in the statewide property tax rate for the 10th consecutive year, the Policy Forum said. The gross property tax rate in Wisconsin fell from $16.78 per $1,000 of property value in 2022 to $15.53 in 2023. That’s the lowest gross property tax rate in Wisconsin since at least 1984.

“When property values go up by a large amount, as they have for the last three years, the actual tax rate goes down,” Sommerhauser said. “(That’s) because the amount that the school districts and the other local governments are collecting, the property tax levy is spread across a larger property tax base.”

He also said the changes in property tax levies vary from county to county, or municipality to municipality.

In the seven counties that make up the southeast region of the state, overall property values increased by 6.2 percent this year, down from the 12 percent growth in 2023, according to the Policy Forum. Walworth County was the only one in the region to experience double digit property value growth at 10 percent, after all seven saw double digit growth in 2023.

Overall tax levies in the region rose by 2.7 percent in 2023, which was lower than the state average and the inflation rate but surpassed the region’s increases in 2021 and 2022, the Policy Forum says.

Sommerhauser said the relatively low increases in the southeast region’s gross tax levy was driven by modest increases in Milwaukee and Waukesha counties, the two most populous in the region. But he said a referendum passed by voters for Milwaukee Public Schools will drive an increase in the school district’s taxes next year.

“That’s going to definitely be reflected in the gross property tax levies that we see coming out this December,” he said.

In Dane County, the Policy Forum said property values rose by 8.4 percent this year, which was more than the state average but lower than the 11.6 percent increase in 2023.

Tax levies from all local governments combined grew by 7.8 percent in 2023, which was higher than the state average and was the largest increase in the county since 2008.

In Madison, the Policy Forum says the total levy growth was 6.4 percent, the largest increase the city had seen since at least 2008. Property values in Madison increased 8 percent this year, down from its 10.5 percent growth in 2023.

“It is up to the local officials in the school districts, the municipalities and the counties to decide how much to increase their levy within the limits and the parameters that the state puts out,” Sommerhauser said. “I think it’s clear, looking at these numbers, that some of the local elected officials in Dane County have chosen to have larger levy increases than in most other parts of the state.”

While property tax levies overall have increased, some local governments across Wisconsin still face budgeting challenges — even after a bipartisan agreement to provide more state funding.

In Madison, voters in November will decide whether to increase taxes to fund city and school district services. The city has warned that if the November referendum fails to pass, it could slash spending by $6 million in 2025, which could include 60 layoffs.

Wisconsin Public Radio, © Copyright 2026, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.