Gov. Tony Evers has vetoed the bulk of a Republican tax cut package that would have expanded a state income tax bracket, exempted retiree income from state taxes and increased a tax credit for married couples.

In a statement, Evers said that while he has “been proud to sign several income tax cuts” during his time in office, the latest GOP bills would have “sent Wisconsin on a path toward insolvency.”

“When we deliver tax relief for the people of Wisconsin—just as we have—it should be real relief aimed at helping Wisconsin’s working families afford rising costs, and it should be responsible and sustainable, ensuring we can keep taxes low now and into the future without causing devastating cuts to priorities like public schools and public safety down the road,” Evers said. “Republican members of the Wisconsin State Legislature today once again fail to balance these important obligations.”

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

Evers also claimed the GOP tax bills could have resulted in the state repaying “billions of dollars in federal relief funds” received under the federal American Rescue Plan Act stimulus of 2021, though his office did not immediately share details on why.

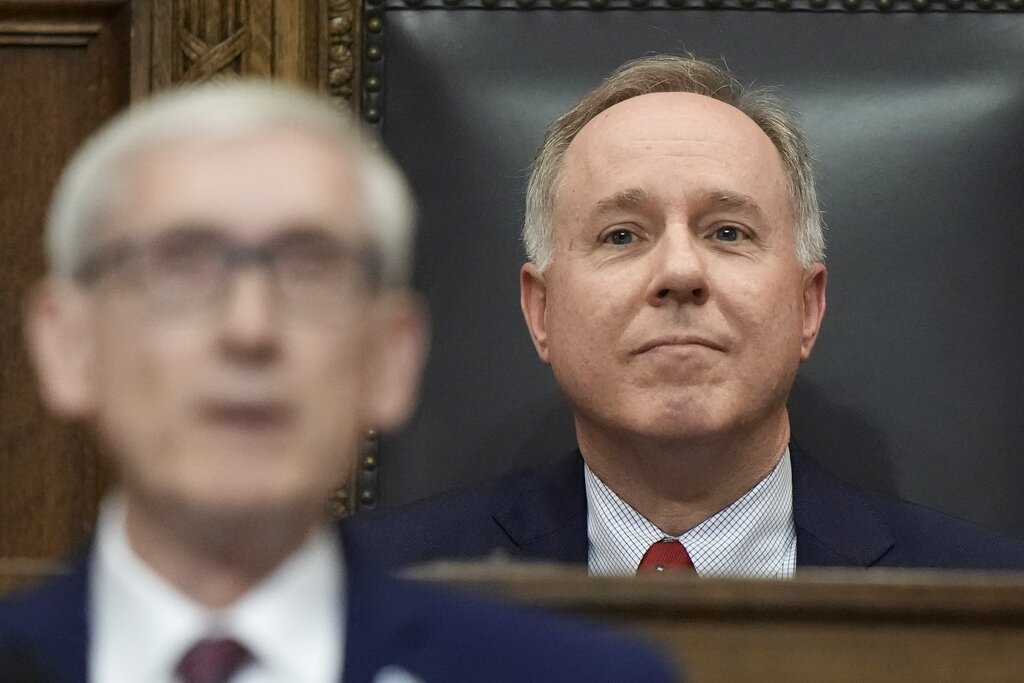

Assembly Speaker Robin Vos, R-Rochester, issued a statement criticizing Evers for rejecting “another round of crucial tax relief,” accusing the governor of prioritizing politics over practical solutions. He alluded to statements Evers had made in the past when the governor referred to families who earn up to $150,000 as “middle class.”

“Despite repeated opportunities provided by Legislative Republicans, Governor Evers refuses to support tax cuts that directly benefit the middle class, even when using defined parameters on what he deems as middle class,” Vos said. “Even more concerning is the Governor’s disregard for Wisconsin’s seniors, who stood to gain significant relief from the proposed tax cut.”

The bills vetoed by Evers would have cut state taxes in a few different ways.

- The largest of the GOP tax cuts would have expanded Wisconsin’s second lowest income tax bracket to cover individuals making up to $112,500 and married couples earning up to $150,000. Currently, the bracket covers individuals earning between $14,320 and $28,640 and married couples making between $19,090 and $38,190. The tax rate for people getting the cut would have gone from 5.3 percent down to 4.4 percent.

- The second-largest plan would have cut taxes on retirees 65 and older by excluding the first $75,000 of retirement income subject to taxes. For married couples, the bill would exempt the first $150,000. The average cut would have been $1,582.

- Another plan would have increased an existing tax credit for married couples from $480 to $870.

Notably, Evers did not take action on a fourth GOP bill aimed at expanding Wisconsin’s credit for child and dependent care expenses to 100 percent of what someone claims on their federal income tax return. Currently, the state credit covers up to 50 percent of the federal credit.

The governor has said “the child care tax credit seems like something that would work.” He has until Tuesday to take action on the bill.

Debate over how to spend $3B budget surplus

Republican leaders have sparred with the governor over the past year over how to spend Wisconsin’s historic budget surplus, which is projected to be more than $3 billion at the start of the next budget cycle.

Even if Evers’ signs the child care tax credit, which is projected to cost the state about $70 million annually, his vetoes Friday mean that most of the surplus will remain intact.

When broken down, the Legislature’s nonpartisan budget office said the income tax cut would have cost the state about $750 million annually, the retiree tax cut would have cost about $470 million and the married couple tax credit would cost more than $160 million. Taken together, they would have added up to nearly $1.4 billion per year in reduced tax revenue, a sizeable chunk of the state’s projected surplus.

In his last budget proposal, Evers sought to use surplus funds on education, broadband expansion, child care, paid family leave and a range of other government programs. The current state budget, passed by Republicans in June, would have used the surplus on a massive income tax cut, including for people who earn more than $300,000 per year.

Wisconsin Public Radio, © Copyright 2026, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.