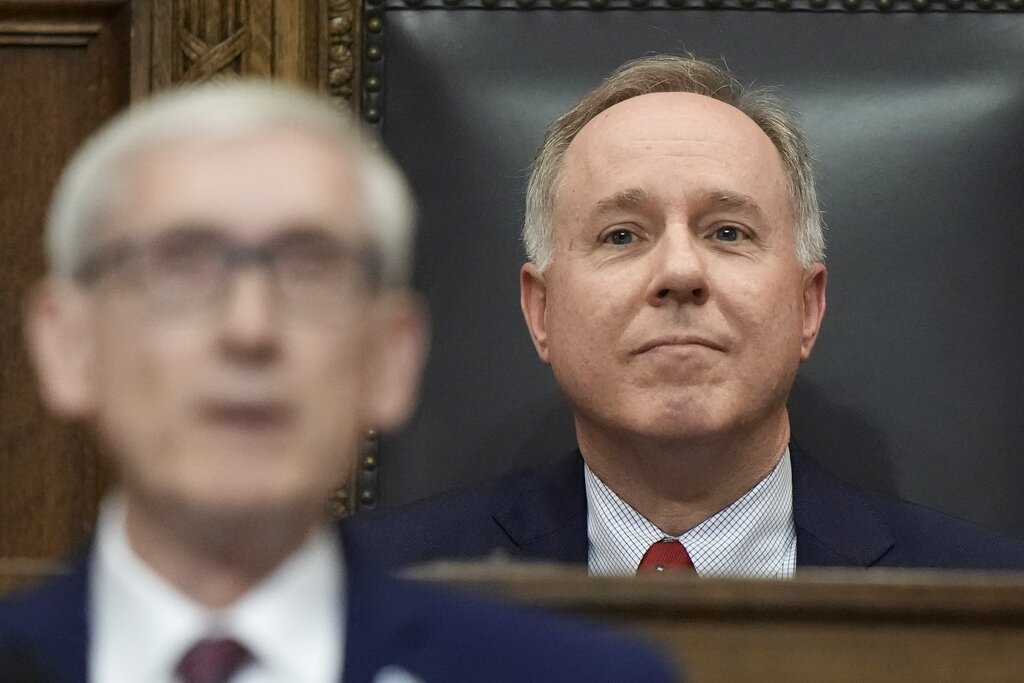

Gov. Tony Evers signed a bill into law Monday that will expand the state’s tax credit for child care expenses.

The move comes after the Democratic governor vetoed the rest of a Republican-sponsored tax cut package last week, warning those measures would put the state on “a path toward insolvency.”

The measure signed by Evers will allow Wisconsinites to claim up to 100 percent of the federal tax credit for child and dependent care on their state taxes starting in the 2024 tax year.

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

Previously, state filers could only claim 50 percent of the federal income tax credit, which applies to money spent on care for a child under 13 or on care for a disabled person.

The changes will increase the maximum credit a Wisconsin filer could claim from $525 to $3,500 for a single dependent, and from $1,050 to $7,000 for multiple dependents.

The changes will affect more than 110,000 taxpayers, with an average benefit of over $656, according to the governor’s office.

In a statement, Evers called the cost of quality child care “too darn high,” and said the credit is one step toward keeping parents in Wisconsin’s work force.

“Signing this bill today will go a long way toward defraying yearly family expenses on child care, giving Wisconsinites some breathing room in their household budgets and making sure our kids have the early support and care they need,” the governor said in written statement, following a Monday morning ceremony at La Casa de Esperanza, a community center and charter school in Waukesha.

The expanded credit, which received bipartisan support from state lawmakers, will cost the state an estimated $73 million in revenue in the 2025 fiscal year, according to Wisconsin’s Legislative Fiscal Bureau.

The measure was part of a tax package that would have cost the state nearly $1.4 billion in revenue annually, according to Legislature’s nonpartisan budget office. Vetoed bills in that package would have reduced taxes for retirees and expanded a tax credit for married couples.

Another vetoed bill would have expanded Wisconsin’s second lowest income tax bracket to cover individuals making up to $112,500 a year, up from $28,640 right now. People affected by the cut would have seen their tax rate go down to 4.4 percent from 5.3 percent.

Wisconsin is expected to start its next two-year budget cycle with a surplus of more than $3 billion, and Republicans have blasted Evers for killing what they describe as tax relief to the middle class.

Meanwhile, Evers has criticized the GOP-controlled Legislature for denying state funding to continue Child Care Counts, a pandemic-era program that used federal COVID relief dollars to give grants to child care centers.

Wisconsin Public Radio, © Copyright 2026, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.