Wisconsin Republicans released a package of tax cuts Tuesday, redoubling efforts near the end of the legislative session to find measures that they say could be signed by Democratic Gov. Tony Evers.

The proposals include a broad income tax cut, as well as other tax breaks focused on marriage, childcare costs and retirement income. Overall, they’d cost an estimated $2.1 billion for the remainder of the state’s current budget and and $1.4 billion every year after that.

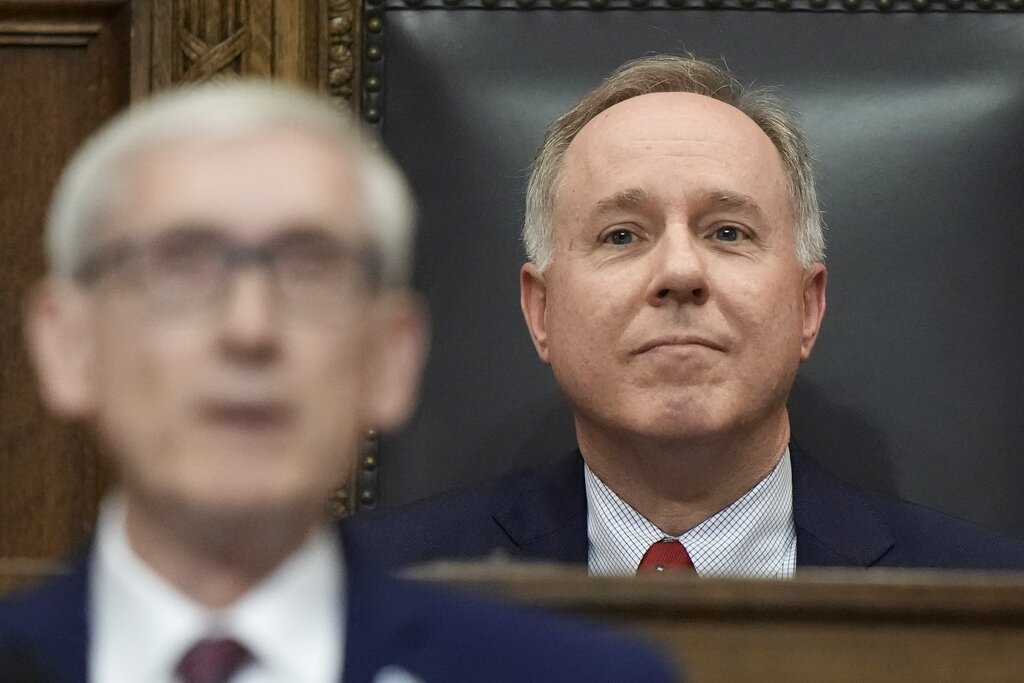

“It focuses on everybody who pays taxes,” said Assembly Speaker Robin Vos, R-Rochester, at a press conference announcing the package.

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

The largest tax cut would expand the state’s second tax bracket to $150,000 for married couples filing jointly. Currently, the income threshold in that bracket is just over $38,000 for married couples. Families in that bracket pay taxes at a rate of 4.4 percent.

The Legislative Fiscal Bureau estimates that the average tax decrease would be $454 per filer under the plan.

“Gov. Evers has said many times that $150,000 is middle class,” Sen. Howard Marklein, R-Spring Green, said at a press conference. “Governor, we heard you and we look forward to getting this proposal on your desk for your signature.”

Senate Majority Leader Devin LeMahieu said recently he was working on details of a plan to expand the second tax bracket to families making up to $200,000 per year. LeMahieu joined Vos and other Republicans at the press conference unveiling the latest tax package.

Other tax cuts focus on child care, married couples, retirement

Another proposal would expand an existing tax credit for child care so that it covers expenses up to $10,000 for one child or $20,000 for two or more children. That would result in an estimated tax cut of $656 according to the Fiscal Bureau.

“The bottom line is we need to relieve our families when it comes to helping them with their child care,” Rep Amy Binsfeld, R-Sheboygan said. “This is a direct payment to those children or to their families, rather than a roundabout way to try and get them back their money.”

The married couple credit would be raised from a maximum of $480 to $870 under another measure. The credit was created in 2001 and would be $870 today if adjusted for inflation, according to the LFB. The average tax cut would be $338.

The retiree tax cut would make income from retirement plans tax free for the first $75,000 for single filers and $150,000 for married couples. It would result in an estimated average decrease of $1,582.

Vos framed a tax cut on retirement income as a way to keep people from moving out of Wisconsin.

“I’m 55, and one of the things, as you get older, you talk to your friends about what they’re gonna do in retirement. And far too many people that I know have been looking at tax climates around the country,” Vos said. “There’s nothing we can do about the weather. But the decision of where to reside for six months and a day is very much on the mind of retirees.”

A spokesperson for Evers said the governor will review the proposals.

“Gov. Evers looks forward to delivering his State of the State address … where he will speak directly to Wisconsinites about the need to find bipartisan support for real, meaningful solutions to address our state’s chronic workforce challenges, including a long-term fix for our looming child care crisis,” communications director Britt Cudaback said in a statement.

Evers signed a Republican-authored tax cut in the 2021 budget that cut income taxes by roughly $2 billion. He has vetoed other GOP proposals, including a tax cut for the highest income brackets in the most recent budget and another bill that would have cut taxes for family income up to about $406,000.

Wisconsin Public Radio, © Copyright 2026, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.