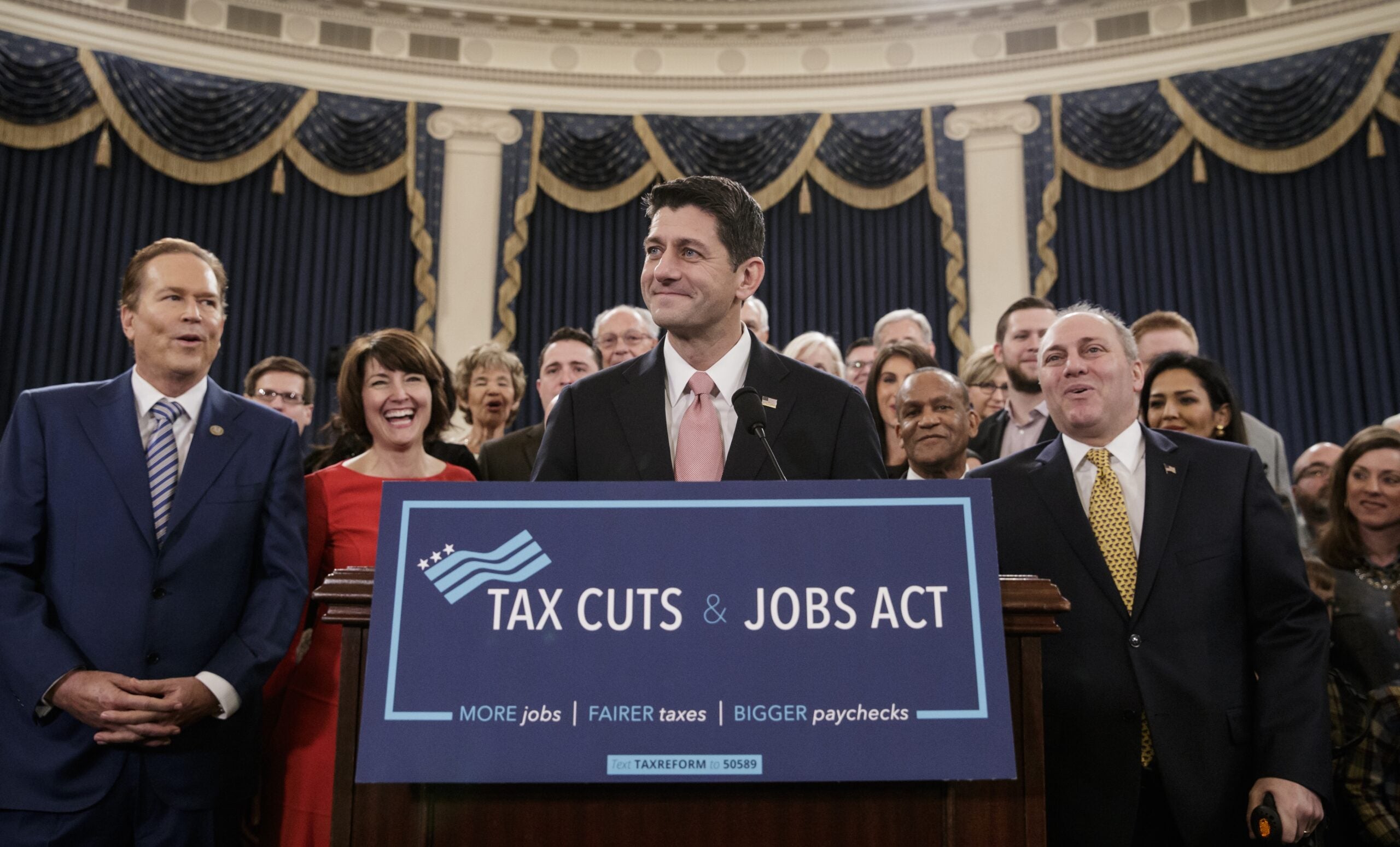

A recently unveiled tax plan proposes sweeping changes for Americans. The plan proposes lowering the corporate tax rate to 20 percent and doubling the standard deduction.

Wisconsin residents who itemize their deductions might notice an impact in their taxes if the proposed tax plan goes through. The proposed plan would eliminate the deduction for state and local taxes. Taxpayers will be able to deduct property taxes, but only up to $10,000.

Wisconsin Taxpayers Alliance President Todd Berry said for a lot of Wisconsin residents, the proposed plan wouldn’t have a huge impact. But it could impact people who itemize their deductions.

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

“If this law doubles the standard deduction for a lot of people that don’t have very complicated tax situations, it may not matter whether they lose an interest deduction or an income or a property tax deduction or whatever because they won’t be itemizing anyway,” Barry said.

The plan is expected to increase the deficit over ten years. For Jon Peacock, director of the Wisconsin Budget Project, this deficit increase is a risk for residents in the long run.

“Once they pass this tax plan, and increase the federal deficit by $1.5 trillion, then they’re going to say they have no choice but to follow through with cuts in popular programs,” he said.

Wisconsin Public Radio, © Copyright 2026, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.