A proposed flat income tax by a top Republican lawmaker would give an average tax cut of over $100,000 to the wealthiest Wisconsinites, according to a new report by the Wisconsin Policy Forum.

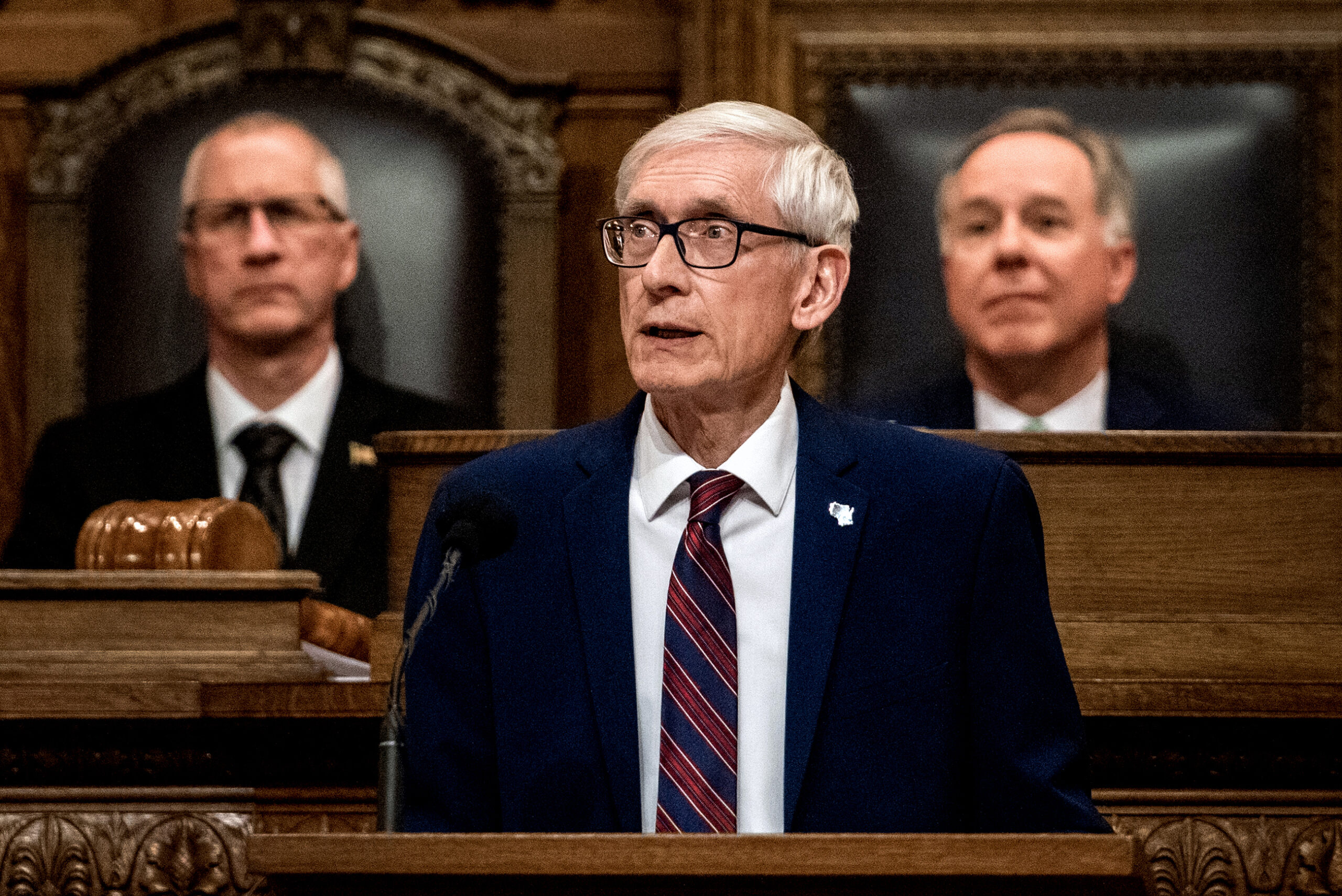

Meanwhile, Democratic Gov. Tony Evers’ tax proposal would mean Wisconsin residents who make more than $1 million in adjusted gross income would see an average tax increase of nearly $40,000.

But it’s unlikely either plan will pass, as the Republican co-chairs of the state’s budget committee said in February they don’t plan to pass a flat tax as part of the biennial budget. Evers has also called the idea of a flat tax a “poison pill” for the budget.

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

The GOP-controlled Legislature is also unlikely to approve Evers’ tax proposal.

The Wisconsin Policy Forum has said that lower income earners would benefit more from Evers’ proposal while a flat tax would likely yield more benefits for those with higher incomes.

“In goals and approach, the two proposals diverge as far as almost any two major tax proposals in memory at the Wisconsin Capitol,” the Wisconsin Policy Forum report said.

Even so, both proposals would have major effects on Wisconsinites who make more than $1 million in adjusted gross income, according to Jason Stein, the author of the report.

“They have this one similarity, and that is of focus on a lot of their changes on people at the very upper income levels,” Stein said.

The average tax increase for that group under Evers’ plan would be more than 20 times as large as the change for any other income group, the analysis found. For Senate Majority Leader Devin LeMahieu’s flat tax plan, the average tax cut for those who make more than $1 million in adjusted gross income would be more than six times as great as for any other income group.

Currently, Wisconsin taxes income at four different rates depending on how much people earn. The wealthiest residents — those individuals who earn more than $280,950 — pay a 7.65 percent tax rate.

LeMahieu, R-Oostburg, proposed a plan last year to establish a flat income tax of 3.25 percent for all taxpayers, regardless of income. He framed the idea as a “transformational” tax change, made possible by the state government’s projected $7.1 billion budget surplus.

“This approach would deliver the greatest benefits to higher-income earners, who pay higher rates on their additional taxable income as they progress through each of the state’s four brackets,” the report said.

Evers’ plan includes a 10 percent state income tax cut for the middle class. Individuals making less than $100,000 and married couples or joint-filers making at or below $150,000 would benefit from the proposal.

“The governor’s plan would also raise taxes on certain taxpayers, generally those with higher incomes, and would keep overall income tax collections essentially flat,” the report found.

Evers’ plan would increase state tax revenues by $257.3 million over the next two years. But it would also increase expenditures on refundable income tax credit payments to individuals and businesses by more than $300 million, which would “more than offset the higher taxes overall,” the report found.

Meanwhile, LeMahieu’s plan would decrease individual income tax collections by a projected $2.11 billion in 2024 and $5.06 billion in 2027 and subsequent years, according to the analysis.

“At present, neither the Evers proposal nor the flat tax plan appear likely to emerge as the final income tax package within the state budget bill. Yet there is also good reason to expect that lawmakers will send Evers a bill with a significant cut to the state’s current income tax as well as other potential tax cuts such as the repeal of the state’s personal property tax,” the report said.

Data from Phoenix Marketing International found that Wisconsin has nearly 138,000 households that make more than $1 million dollars a year.

Under Wisconsin’s progressive income tax, people who earn up to $12,760 are taxed at a rate of 3.54 percent, people with incomes between $12,760 and $25,520 are taxed at a 4.65 percent rate, and people who earn between $25,520 and $280,950 pay a rate of 5.3 percent.

In 1911, Wisconsin became the first state to implement an individual income tax. The Wisconsin Policy Forum found that Wisconsin’s top marginal rate ranks as the eighth-highest of any state in the country.

Wisconsin Public Radio, © Copyright 2026, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.