This year, Medicare will start negotiating lower prescription drug prices. But one Wisconsin insurance broker says people will have to wait a few years to see prices go down.

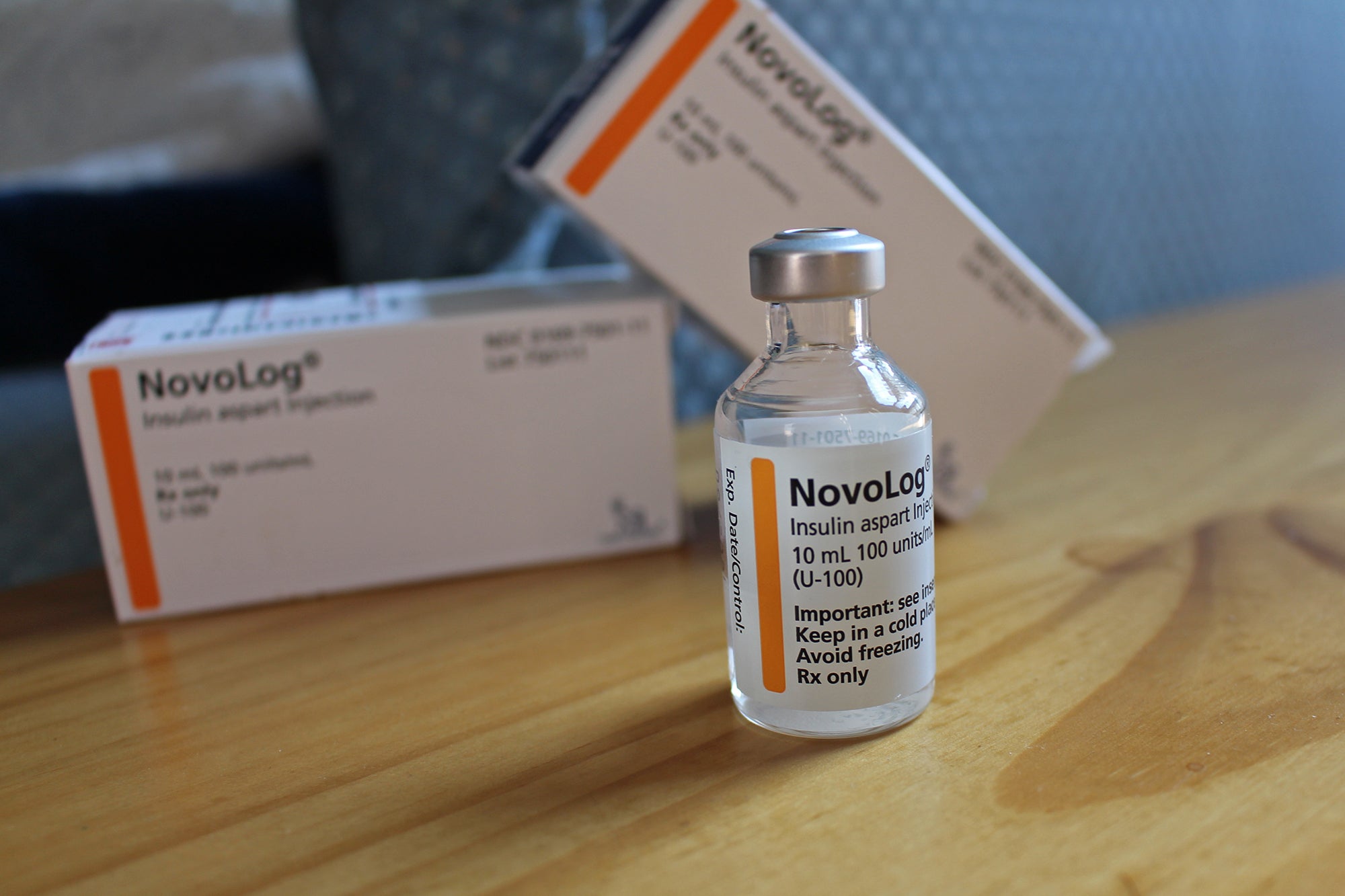

The first 10 drugs to be made more affordable are widely used to treat blood clots, heart conditions, diabetes, kidney disease, arthritis and blood cancer. These drugs cost Americans $3.4 billion out-of-pocket in 2022, according to the Biden Administration.

The Inflation Reduction Act, signed into law last year, allows Medicare to negotiate prices for up to 60 drugs covered under Medicare Part D and Part B over the next four years, and up to an additional 20 drugs every year after that.

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

Sadie Tuescher, an independent broker with Wisconsin Health Insurance Advocate, recently joined WPR’s “The Morning Show” to discuss what people should know about the coming changes to prescription drug prices under Medicare and Medicaid.

“We’re really hoping this will equate to savings long term, especially for prescriptions that are essential, life-saving and don’t have viable generic alternatives,” Tuescher said.

The following was edited for brevity and clarity.

Kate Archer Kent: Let’s begin with prescriptions. Price negotiations with drugmakers will soon begin for 10 drugs covered under Medicare. What should people understand about the federal government’s price review process?

Sadie Tuescher: There’s a lot to understand. Brand names are incredibly expensive under the Medicare Part D program, so this is exciting news.

Beneficiaries really shouldn’t expect very immediate relief, though. People are going to see the biggest impact in 2025 when there is a $2,000 cap or out-of-pocket maximum on prescription drug pricing. We’ll see some slight changes for 2024 (when patient cost-sharing for prescription drugs in the catastrophic phase of the program will end), but the major changes are going to happen in 2025 and beyond.

KAK: You say the most frequent questions you get from clients are about capping out-of-pocket drug costs with Medicare. What should people know about maximum costs?

ST: I think the best thing to know is that relief is coming, which is fantastic, thanks to the Inflation Reduction Act.

A $2,000 cap (on prescription drugs) might sound like a large amount, but I did a search for a client a couple of weeks ago and her out-of-pocket costs were well over $10,000. And that’s not all that irregular when it comes to a Medicare prescription drug benefit, especially if someone needs brand-name drugs.

This will be a good first attempt by the federal government to put caps on the absolutely exponential cost of prescription drugs that we have seen over several decades. There’s been no control on the pricing of drugs. And that can really affect seniors. The 2003 Medicare Modernization Act prohibited the federal government from negotiating prices, so that really hurt. It just let drug companies set whatever prices they want for prescriptions.

KAK: COVID-19 is no longer considered a national emergency by the federal government. As a result, Medicaid continuous enrollment ended earlier this year. Who is most at risk of losing Medicaid coverage this year?

ST: Anyone whose income has changed significantly because they’ve got a different job or if they suddenly have some savings. I know a lot of people took advantage of the extra unemployment benefits, and so they have savings above the limits. So anyone whose income has changed since they first applied, those are the people who are losing it now.

KAK: More than 240,000 Wisconsinites left Medicaid as of Nov. 8, according to an analysis by KFF, formerly known as the Kaiser Family Foundation, now an independent health research organization. What health care options are available to people losing Medicaid coverage this year?

ST: For people under the age of 65 or those who aren’t eligible for Medicare, they can go to the Affordable Care Act or healthcare.gov marketplace. Many of those people are eligible for subsidies. It certainly is going to be more expensive for them than Medicaid.

And for people who are eligible for Medicare, they essentially will need to switch plans. Many beneficiaries who are on Medicare and Medicaid have what’s called a dual needs plan. They’re great plans, but people need to switch out of those or they will lose the benefits.

KAK: What is often misunderstood about these programs?

ST: For me, the most frustrating thing is the commercials, particularly Medicare Advantage commercials. I don’t want to say that they’re misleading, but they only highlight certain benefits.

KAK: Zero premiums, free exercise classes, preloaded debit cards. Can I keep going?

ST: Exactly. Thank you, that is a really good point, Kate. That is probably my biggest frustration, the preloaded debit cards or help with utility bills or groceries. Those are all dual needs plans for people who are eligible for Medicare and Medicaid.

There are also a lot of unsolicited calls from call centers. They start by telling you that benefit. But inevitably, they find out you’re not eligible for Medicaid because that’s a relatively narrow population. Then they … bait and switch you to a different plan. I’ve spoken to a large number of people who got calls from representatives somewhere who switched them to a plan that didn’t cover their doctors or their local hospital or the medication that they need.

That’s why I really encourage getting help, whether that’s through a broker, the Medigap program or your local county’s aging and disability resource center. Medigap plans, in my opinion, are really good for people who have higher medical needs. They cover more, but you pay for it in a monthly premium.

KAK: How much help is there to do this? How do people figure out where to go from here with their plans?

ST: I am somewhat biased because I’m an independent agent. I always recommend finding a local independent agent or broker, ideally someone who represents a whole bunch of plans, not just one plan or one company so that they can comparison shop for you.

There is also the Medigap Helpline (800-242-1060), which is the health insurance program run through the state of Wisconsin. The folks there actually do have independent agent licenses, but they are paid through the state instead of commissions through insurance companies. Both of those are good options, especially to get local assistance.

I actually came out of Milwaukee County Aging and Disability Resource Center, which each county has. Get some local help from someone who does this every day. Medicare is extremely complicated. We are experts in this field. There’s a lot of help available.

Wisconsin Public Radio, © Copyright 2026, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.