Find out about the debit card fraud happening in Wisconsin and what precautions you should take. Plus, an update on the latest scams making their way around the state.

Featured in this Show

-

What To Know About New Embed Chip Credit Cards

Recently, there has been a growing, nationwide shift from credit card issuers toward a new square, metallic chip being added to front of the cards in order to decrease fraud. Experts from the state Department of Agriculture, Trade and Consumer Protection want to both prepare and warn new users ahead of this transition.

Sandy Chalmers, of the DATCP, and Michelle Reinen, director of the Bureau of Consumer Protection, said there are positives and potential problems that credit card holders might now face.

According to Chalmers, the new credit cards and their chips have been formatted to create a higher level of security than the older, magnetic one. This new credit card also has a new system, where instead of swiping the card, it must be “dipped,” according to Chalmers.

“The credit cards that are being issued now have the embed chip and the magnetic strip,” Chalmers said. “If you have an option of dipping or swiping, you should dip because it is more secure.”

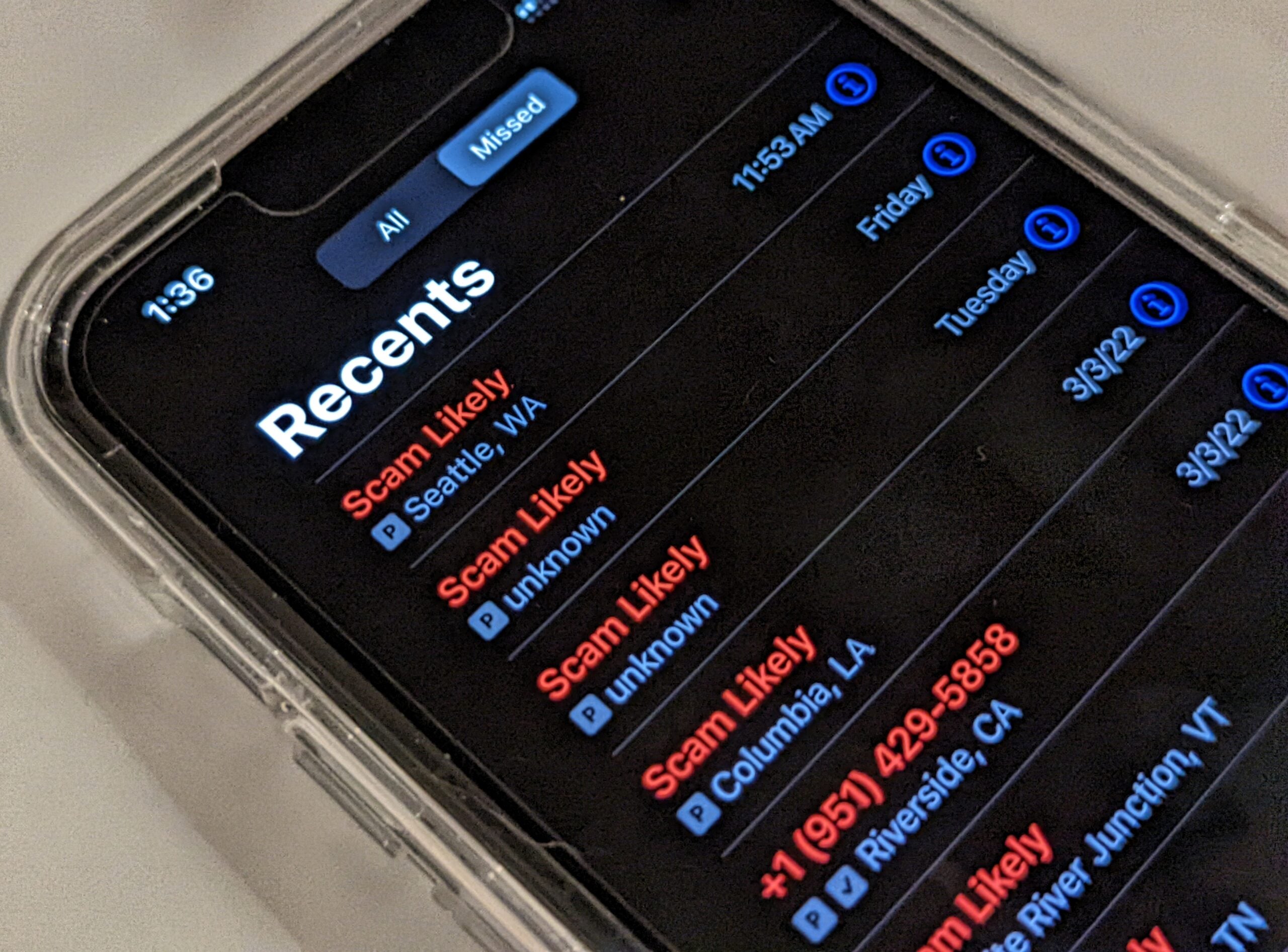

One issue they have heard of a number of times are customers receiving emails from a company asking the card holders to provide the criminals with all of their information, like their Social Security or pin numbers. Chalmers said that no card issuer should be contacting a holder by email, therefore, that is a noted sign the email is a scam.

“We hear a lot about these phishing emails. They always follow news and anytime there is anything new where they can catch people off guard, they will do that,” Chalmers said.

Another market that allows for credit card scams is the holiday season. Reinen said that shipping scams, through online shopping, are the largest issue many holders face during this time of the year.

“You want to watch your inbox for an email from FedEx or UPS indicating that ‘here is your tracking number,’ and then they have a link, where you can follow the shipment,” Reinen said. “It’s that link you want to be careful of not to click it. They are going to ask for personal identifiable information … about your package … or they are going to be potentially putting malware on your system.”

Reinen said that when she does online shopping, she documents who is supposed to be sending her a package and when it is expected to arrive. The scammers are commonly waiting and depending on shoppers to lose track of this type of information.

Lastly, potential scams have been surrounding the elderly, who are receiving emails and phone calls from fake insurance companies asking about their Medicare number, Chalmers said. She suggests hanging up immediately if they asking to replace the Medicare card.

“Medicare never calls and asks you to verify personal information Some of these calls can be very threatening … (and the companies) preys on the vulnerability of an elderly person,” Chalmers said.

To help protect the elders, Chalmers and Reinen recommend downloading or ordering a booklet, called the “Senior Guide”, that should be kept by landlines to refer to it if any problems arise. According to the DATCP website, it includes many topics about consumer protection, including how to file a complaint and applying for the “No Call” list.

For further information on credit card scams and receiving the senior guide, visit datcp.wi.gov or call the toll-free number at 800-422-7128.

Episode Credits

- Larry Meiller Host

- Cheyenne Lentz Producer

- Rebecca Haas Producer

- Sandy Chalmers Guest

- Michelle Reinen Guest

Wisconsin Public Radio, © Copyright 2025, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.