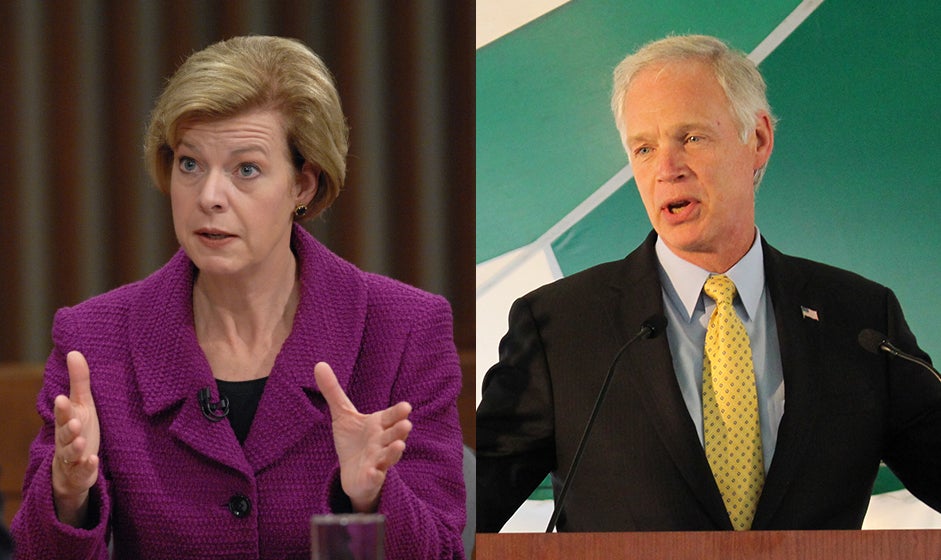

The Obamacare individual mandate would be eliminated under the Senate’s tax reform plan. We talk with Sen. Ron Johnson about that provision and other components of the proposal.

Senate Majority Leader Mitch McConnell said on Tuesday that the individual mandate repeal will make it easier to win over the 50 votes needed to pass the bill. The mandate imposes a federal penalty on people who do not buy health insurance.

The plan would also cut the corporate tax rate from 35 percent to 20 percent, but not until 2019. President Donald Trump has demanded that cut take effect immediately. In addition, the Senate version would end the deduction of certain state and local taxes but maintain the mortgage interest deduction. It would also nearly double the standard deduction for people who don’t itemize their returns and expand tax credits for families with children.

How do you feel about the plan to nix Obamacare’s individual mandate? Do you generally support or oppose the Senate’s tax overhaul effort? Give us a call at 1-800-642-1234 or email ideas@wpr.org. You can also tweet us @wprmornings or post on the Ideas Network Facebook page.

Episode Credits

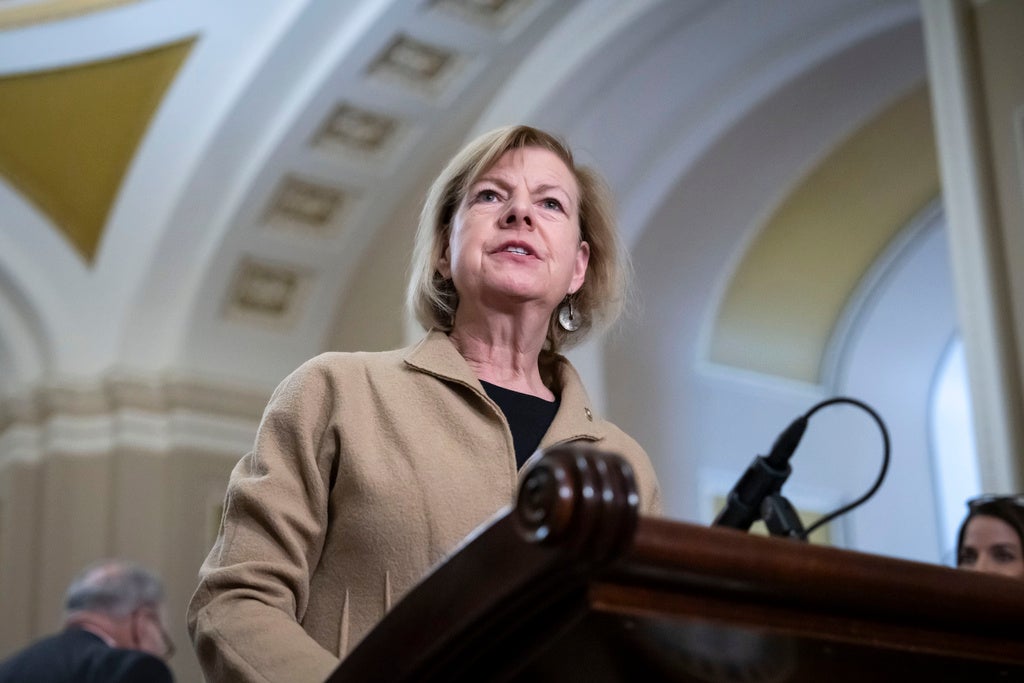

- Kate Archer Kent Host

- Bill Martens Producer

- Ron Johnson Guest

Wisconsin Public Radio, © Copyright 2026, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.