Wisconsin’s unemployment reserves averted catastrophe during the pandemic, but the state has work to do to ensure the fund can withstand job losses from a potential future recession.

That’s according to a new report released Tuesday by the Wisconsin Policy Forum. It examined how the state avoided increasing the tax burden on employers during the pandemic-induced recession to fund its unemployment system, and examined where Wisconsin’s unemployment reserves sat by the end of 2022.

While the state’s unemployment fund has increased since the pandemic cut it nearly in half, it still isn’t at pre-pandemic levels and only has enough money to cover about 6.5 months of unemployment benefits if it were to reach a historically high jobless rate, the report said. The federal government recommends states keep enough money on-hand to cover one year.

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

“The unemployment fund has dropped out of the headlines, and it is no longer getting the attention that it got in early 2020 — and that’s appropriate because things have improved and it’s no longer in dire condition,” said Jason Stein, research director for Wisconsin Policy Forum. “But there remain issues, and we shouldn’t have it dropped entirely off the radar.”

Three years after Wisconsin’s unemployment rate reached a record-high of 14.1 percent, the state maintained record-low unemployment last month at 2.4 percent.

In the early days of the pandemic, Stein said the state’s jobless fund was staring down a “near-death experience,” and — without federal interventions — likely would have hit a deficit. That would have caused an increased tax burden for businesses and required the state to borrow money from the federal government to cover jobless claims.

Unemployment is funded by state and federal payroll taxes that are paid exclusively by employers, but can indirectly limit compensation for workers, the report says. Typically, employers responsible for a greater proportion of layoffs are required to pay more than those with fewer layoffs.

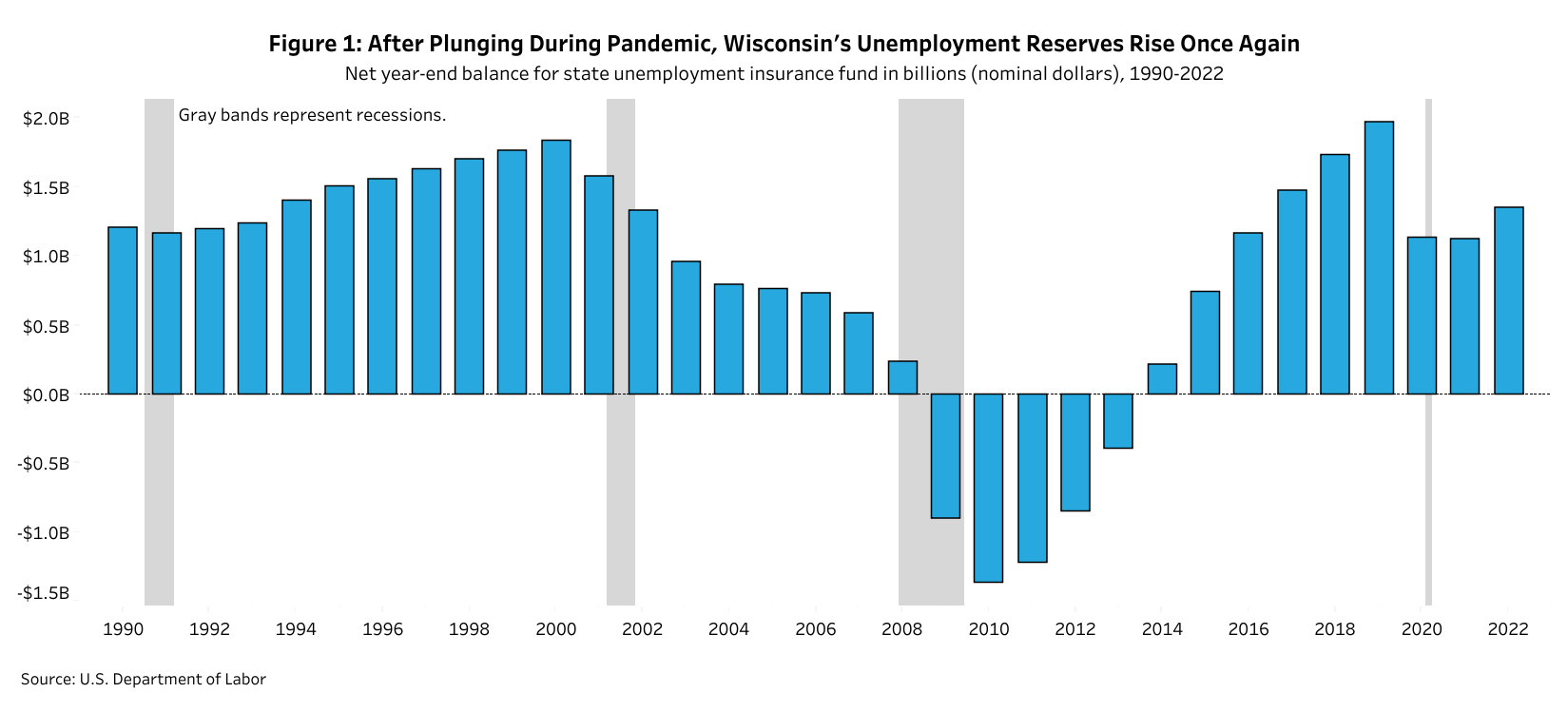

During the Great Recession, Wisconsin’s unemployment reserves ran out of money. In fact, its year-end fund balance was negative from 2009 through 2013 — with 2010 being the worst year with a negative balance of $1.4 billion, according to the report.

Wisconsin had to borrow money from the federal government to pay for its dislocated workers’ unemployment benefits. At one point, the state carried $1.7 billion in debt, the report noted.

“That is not ideal because then additional federal taxes are assessed on Wisconsin employers in the middle of a recession, or the aftermath of recession,” Stein said. “At a moment where the economy’s not doing well, and employers are laying off workers, the unemployment fund is there to help those workers, but it’s also there to help all of us because it helps to cushion the overall shock on the economy.”

Wisconsin was not one of the 22 states that borrowed money from the federal government to make jobless payments during the pandemic. But that’s not to say the state’s unemployment reserves weren’t impacted by COVID-19. From 2019 to 2020, its end of year fund balance dropped from $2 billion to $1.1 billion, according to the report. It stayed at $1.1 billion in 2021.

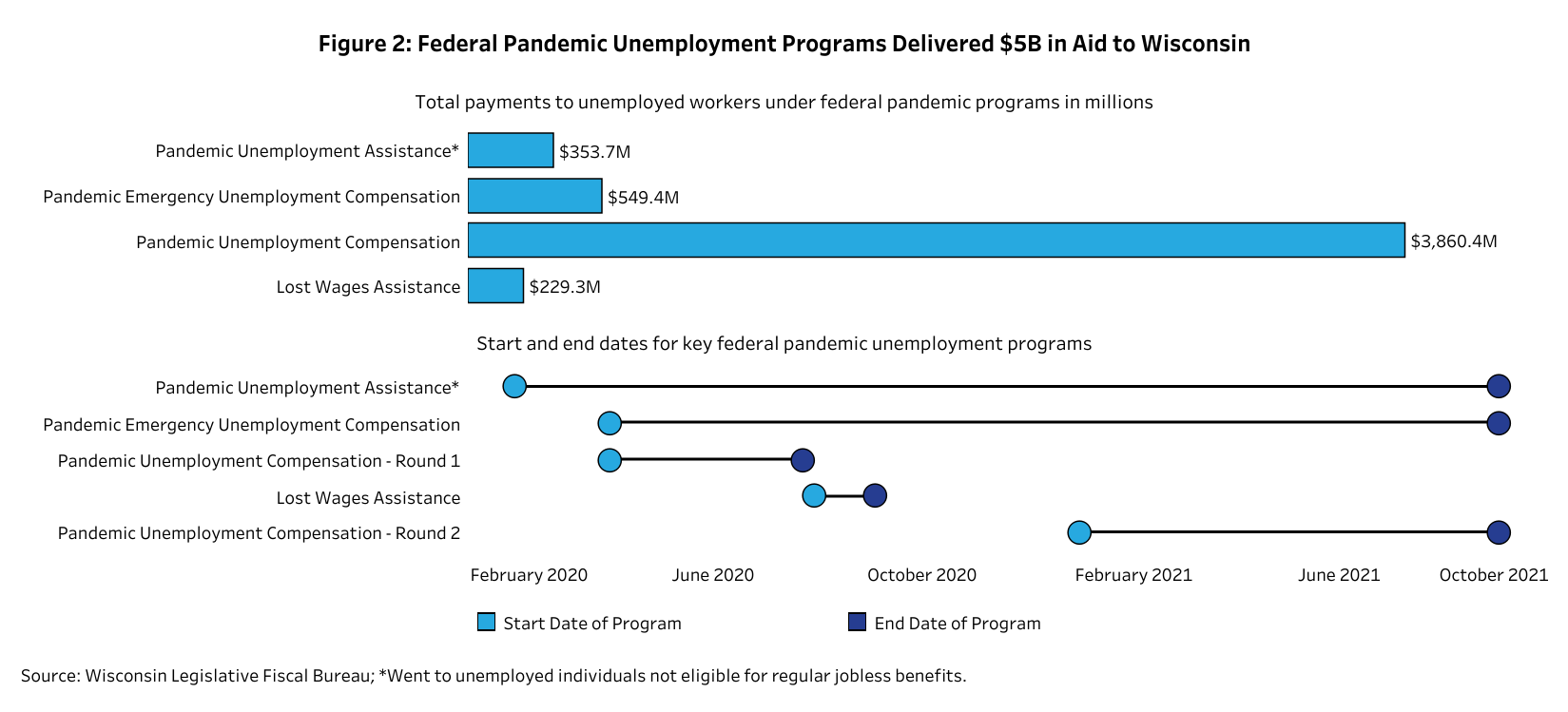

But pandemic-era assistance from the federal government helped the state avoid hitting a negative unemployment reserve balance, said Stein.

“The federal government stepped in directly with unemployment programs, and it also stepped in indirectly to boost the economy in many other ways that limited unemployment claims going forward — starting with the CARES Act and going through a series of other pieces of legislation and federal action, which culminated in the American Rescue Plan Act,” he said.

Federal programs brought nearly $5 billion into Wisconsin to help those affected by pandemic layoffs, temporarily increasing weekly payments for dislocated workers and extending benefits to individuals who previously wouldn’t have qualified, the report says.

The state Legislature and Gov. Tony Evers also approved transferring $120 million in general fund revenues into the state’s unemployment fund balance for the current two-year state budget, and suspended a rule to keep payroll taxes low while employers recovered from the pandemic, the report says.

Wisconsin’s unemployment reserves increased to end 2022 at $1.4 billion, still below 2019’s $2 billion, and below federal recommendations, according to the Wisconsin Policy Forum. Meeting the federal benchmark of being able to fund one year of benefits at historically high levels would qualify Wisconsin for interest-free federal loans if the state needed to borrow to fund the program.

The report lists some ways policymakers could help Wisconsin prepare for a possible recession including using the state’s nearly $7 billion budget surplus, reducing unemployment benefits in targeted ways or increasing revenues from state payroll taxes.

“None of these options are painless,” Stein said, noting that using the state’s one-time budget surplus could be less problematic than some of the other options.

“Putting some of it into the unemployment fund would be a one-time use of the funds,” he continued. “In that sense, it wouldn’t set up budget problems for the state in the future, and, in fact, it would do the opposite — it would make the state better prepared for the future.”

Wisconsin Public Radio, © Copyright 2026, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.