A northern Wisconsin town has been granted a $610,000 loan by the state public lands board to ease financial challenges resulting from a federal court ruling that removed tribal residents from the tax rolls.

Last summer, a federal appeals court ruled the state could no longer tax tribal properties on reservation lands of four northern Wisconsin tribes. The decision stems from a federal lawsuit brought by those tribes in 2018, including the Bad River Band of Lake Superior Chippewa.

The tribes argued their members were immune to state taxation for all time under the 1854 treaty that set aside their reservations, saying taxation threatened their involuntary removal in the event of foreclosure. The state had unsuccessfully argued that tribal properties could be taxed if they had ever fallen out of tribal ownership.

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

The decision meant the town of Sanborn that lies entirely within the Bad River reservation had to remove tribal residents from its tax rolls, causing tax bills to more than double for remaining residents.

Town leaders sought the loan from the state Board of Commissioners of Public Lands to help refund tribal members who paid taxes under protest prior to the court decision. The town owes around $1 million plus interest to satisfy claims brought by about 40 tribal residents.

The board, made up of the state’s constitutional officers, voted 2-1 on Monday to grant the loan to the town after previously expressing doubts about the town’s long-term financial viability. Wisconsin Attorney General Josh Kaul and State Treasurer John Leiber had feared a massive spike in property tax rates would force people from their homes, decreasing the town’s tax base and its ability to make payments on the loan.

Since then, the town has agreed to freeze its tax levy for the next three to five years. The town and tribe have also reached an agreement in which Bad River has agreed to pay $90,000 each year to help fund emergency services to Sanborn. The town is also seeing a $54,000 increase in shared revenue or state aid. Kaul said those factors helped alleviate his concerns with issuing the loan.

“I think that that materially changes the circumstances in a way that significantly decreases the risk of a loan,” Kaul said.

Leiber was the sole commissioner to vote against the loan.

“This does move it in the right direction,” Leiber said. “I guess we’ll see if it’s far enough for both of us.”

Previously, the state Department of Revenue estimated that tax bills for a $200,000 home in the town could climb to roughly $7,400 next year. That’s almost 60 percent more than what property owners paid prior to the court ruling last summer. After the changes, nontribal residents would be expected to pay about $5,300 in taxes on a $200,000 property in 2024, according to the Department of Revenue.

The board is granting the loan just a week before the town needs to issue refunds to tribal members who paid taxes under protest while the tribes’ case was pending. The town must pay those tribal residents within one year of last summer’s court decision in line with state law. Sanborn’s leaders also plan to submit a request to charge other taxing entities like the county and surrounding schools for their portion of taxes that tribal members paid by Oct.1.

While the Department of Revenue is issuing preliminary findings of those requests this week, an agency spokesperson said any chargebacks submitted by the town won’t be reviewed in time. The agency expects to communicate its findings to the county and other entities as soon as possible.

Town Chair Luis Salas said the loan will provide financial stability for the community.

“I believe that it should really be able to make all the community feel better about the future of the town,” Salas said. “And, hopefully, we can start mending fences.”

The removal of tribal properties from the tax rolls was a victory for tribal sovereignty, but it has generated anger among residents as nontribal residents have seen their tax bills skyrocket.

The loan will allow the town to pay off the first four years of tax refund claims to tribal residents. Ashland County, the local school district and technical college would be on the hook for about $400,000 if the town’s chargeback request is approved by the Department of Revenue, according to board figures.

Ashland County Administrator Dan Grady has previously said the chargeback request could mean that county residents will either receive fewer services or pay more in taxes through borrowing. Grady was not immediately available for comment.

Salas said it may be possible that state funding provided under the recently passed 2023-2025 state budget could help offset chargebacks to the county and schools.

Danielle Kaeding/WPR

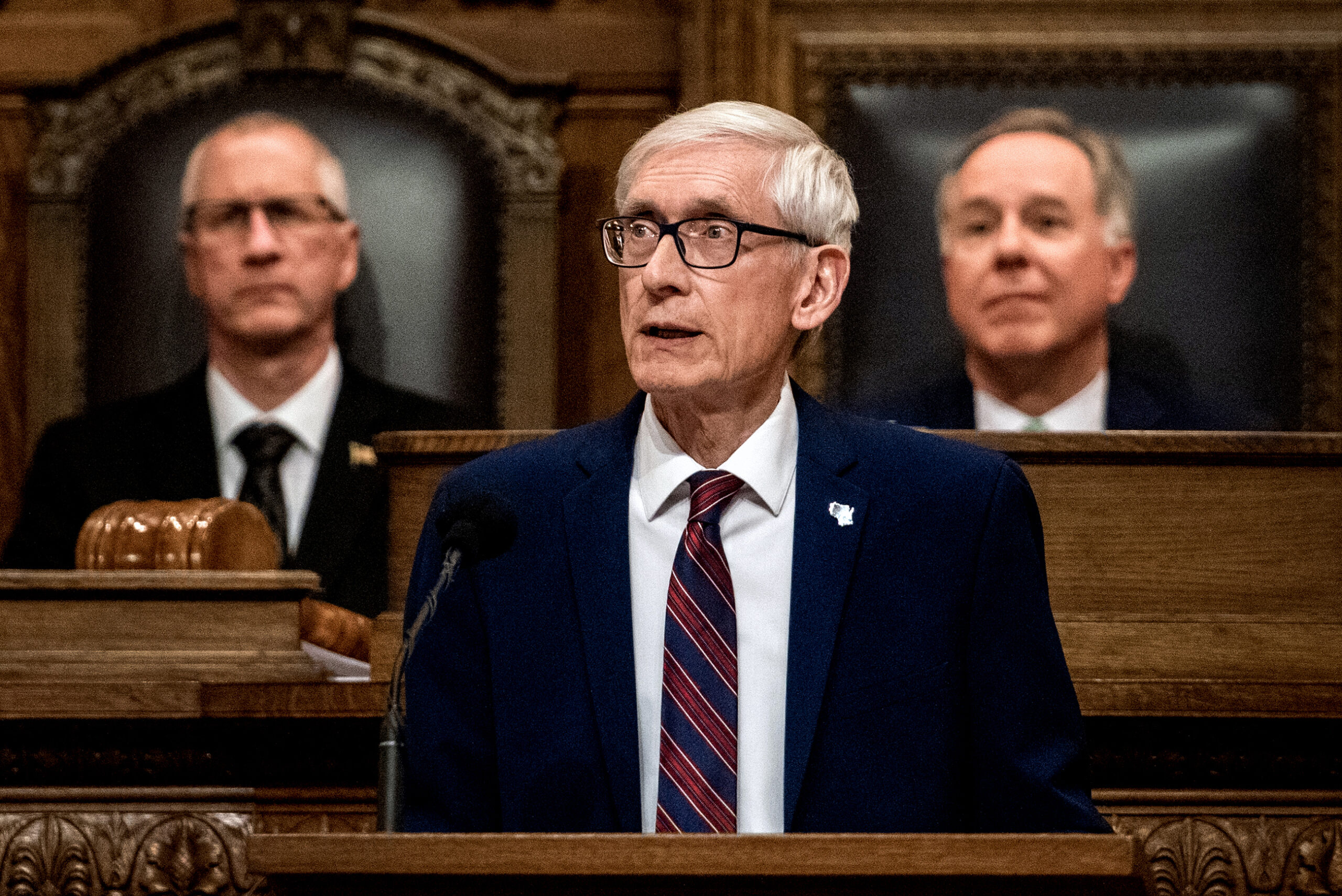

Republican lawmakers on the state’s budget-writing committee included $3.6 million in aid to five northern Wisconsin counties facing a loss of revenue after the court decision. Democratic Gov. Tony Evers approved aid payments to counties under the budget, but he vetoed GOP restrictions on the funds. Lawmakers wanted to limit the town of Sanborn’s ability to raise property taxes, borrow money or charge the county and schools for refunds it owes to tribal residents.

Funding provided through the budget only covers lost revenue from tribal members who withheld tax payments while the tribes’ case was pending. The money doesn’t account for the cost to refund tribal residents, and it doesn’t address the anticipated loss of tax revenue moving forward.

Sanborn resident Sandy Deragon, who is a Bad River tribal member, said she’s been told that refund checks will be in the mail to tribal residents by Friday. For her, the ongoing battle was never about money but rather ensuring the tribe’s treaty rights are upheld.

She said some tribal members lost their homes to foreclosure due to an inability to pay taxes to the town and other entities.

“My husband died before he could collect the money they took from us,” Deragon said. “I guess he’s looking down, probably smiling … People forget that we are the owners of this (land) — not the other way around.”

Wisconsin Public Radio reached out to nontribal residents of the town for comment, but requests weren’t immediately returned. Rep. Chanz Green, R-Grand View, said Tuesday that the town’s agreement with the tribe and decision to freeze the tax levy are good steps forward. Even so, he said the loan creates a tax burden on nontribal residents who he fears are being taxed out of their homes following the court decision.

“I think the governor, the tribes, and legislators have to get together at a table and hammer out all these finer details for a long-term solution, and I hope we can do that moving forward,” Green said.

Sen. Romaine Quinn, R-Cameron, has previously said lawmakers are pursuing a bill to address ongoing issues and restore provisions that were vetoed by Evers under the budget.

Wisconsin Public Radio, © Copyright 2026, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.