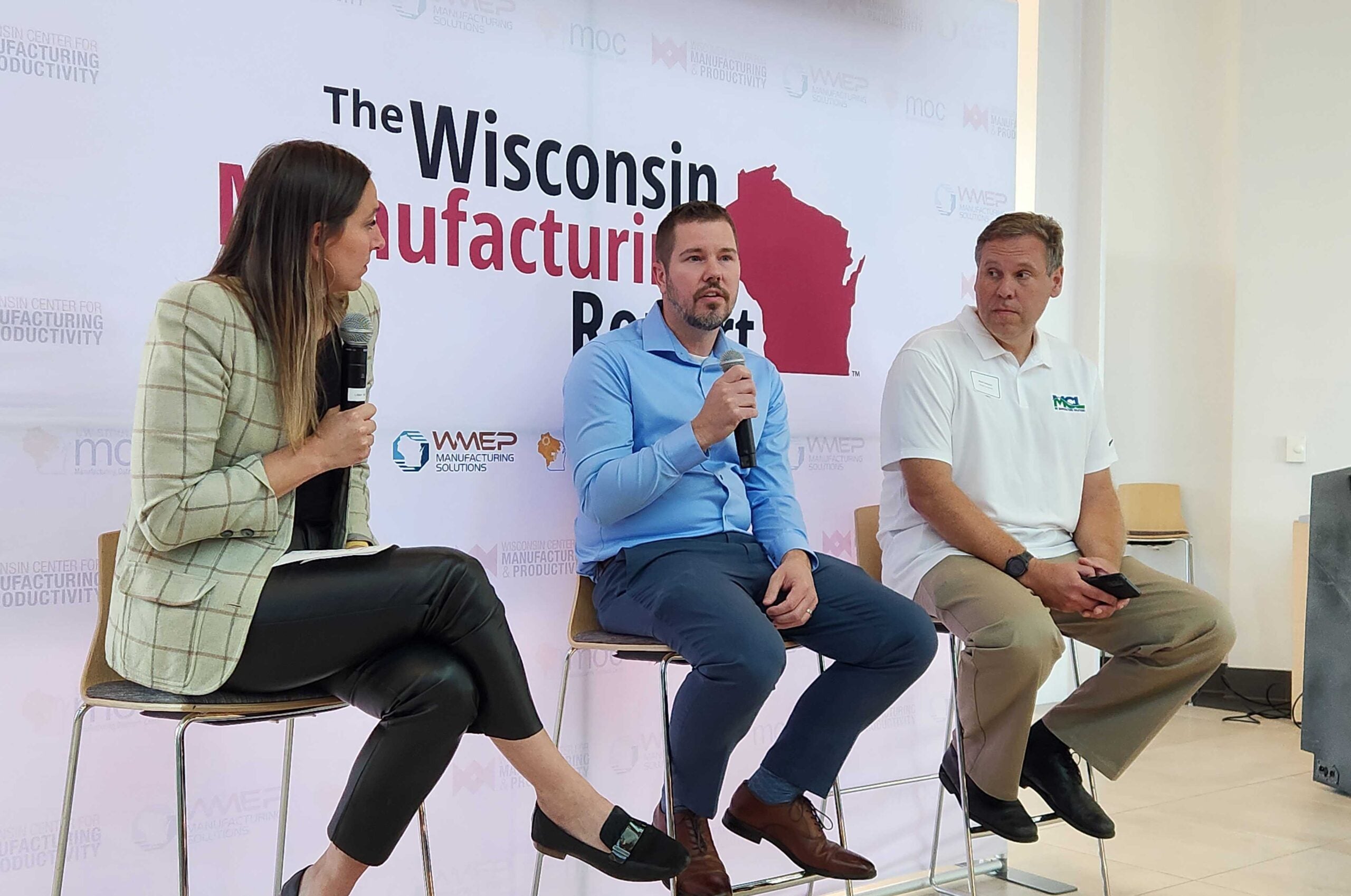

When many think of Wisconsin’s economy, they envision dairy farms and manufacturing facilities. But investment firms have taken increased prominence in the state’s economy in recent years — beyond just Madison and Milwaukee.

Since 2017, Wisconsin has seen a steady increase of investment in startup companies. That includes the record $868 million the state’s entrepreneurs raised in 2021, according to the Wisconsin Technology Council’s 2022 Wisconsin Portfolio, which measures investment in early-stage companies from the prior year.

In working on the 2023 portfolio, Wisconsin Tech Council President Tom Still said it looks like overall investment in startups in 2022 was less than it was in 2021. But he expects last year’s investment to remain higher than 2020’s total of $483 million.

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

“I’m pretty convinced, with our early results, that we’re going to see somewhere north of $500 million in investments,” he said. “We don’t know how far north right now.”

The two most common types of investors in new companies are angel investors and venture capital firms. Angel investors provide funding to startups usually in exchange for debt or ownership equity, while venture capital firms fund emerging companies deemed to have growth potential.

Craig Dickman, managing director for Green Bay-based TitletownTech, said venture capitalists are crucial for businesses in the earliest stages of development and often serves as the first money a business receives to get off the ground.

“It’s probably the most important time for a founder to get money because if they can’t get started, they can’t build,” he said.

Still views 2021’s record investment as a bit of an outlier — primarily due to several companies making initial public offerings. He said 2022’s total investment will be closer to the more gradual increases the state saw in 2019 and 2020.

“We’re still continuing on what I think is a good trend line,” he said. “Venture capital tends to be lumpy anyway. You can look back at some previous years as you go back into the 2000s, and nationally, there are ups and downs that are pretty stark, but Wisconsin’s overall trend line continues to look good.”

Even so, he said he believes several trends from 2021 will continue, including increased spending from out-of-state investors and increased investment activity in northeast Wisconsin.

Out-of-state investors see opportunity in Wisconsin

One area that’s changed in Wisconsin’s entrepreneurial ecosystem is the role of out-of-state investors.

In 2021, 90 out-of-state investors took part in 42 investment rounds, an increase of over 60 percent from the previous year, according to the 2022 Wisconsin Portfolio.

Still said out-of-state investors look at Wisconsin for a variety of reasons, ranging from its medical technology sector to advanced manufacturing and even gaming software.

“This used to be almost exclusively a med tech state, and that is still really strong in Wisconsin,” he said. “But now there are just these other sectors that are coming up.”

Because Wisconsin’s venture capital and angel investor firms are typically smaller than major national firms, Still said out-of-state investors are able to provide a larger financial impact.

“When out-of-state investors get involved, it means there’s more money involved, and it can help bring some companies to the next stage,” he said.

Investment picking up steam outside Wisconsin’s two largest cities

While Madison and Milwaukee have traditionally received the most investment dollars, the 2022 portfolio noted that northeast Wisconsin saw increased investment in startups.

The region saw 15 early-stage companies secure funding in 2021, more than double the previous year and could be the start of a trend, the report says. In fact, Northeast Wisconsin accounted for roughly 10 percent of deals made in 2021.

In 2022, the Wisconsin Tech Council had already tracked five deals in the region, totaling about $12 million. But Still said those numbers could increase by the time the 2023 report is released.

“It may still hit 15 (deals) because there are things we haven’t uncovered yet,” he said. “There’s a lot of stuff we have to go through yet with the SEC (U.S. Securities and Exchange Commission) reports and state revenue reports. But that shows there’s increased interest in the region.”

One reason for the region’s increased investment activity, Still said, are the resources the region has deployed to develop its startup ecosystem.

“There have been more investors in northeast Wisconsin looking for deals and helping to bring them forward,” he said. “TitletownTech is a great and perhaps leading example.”

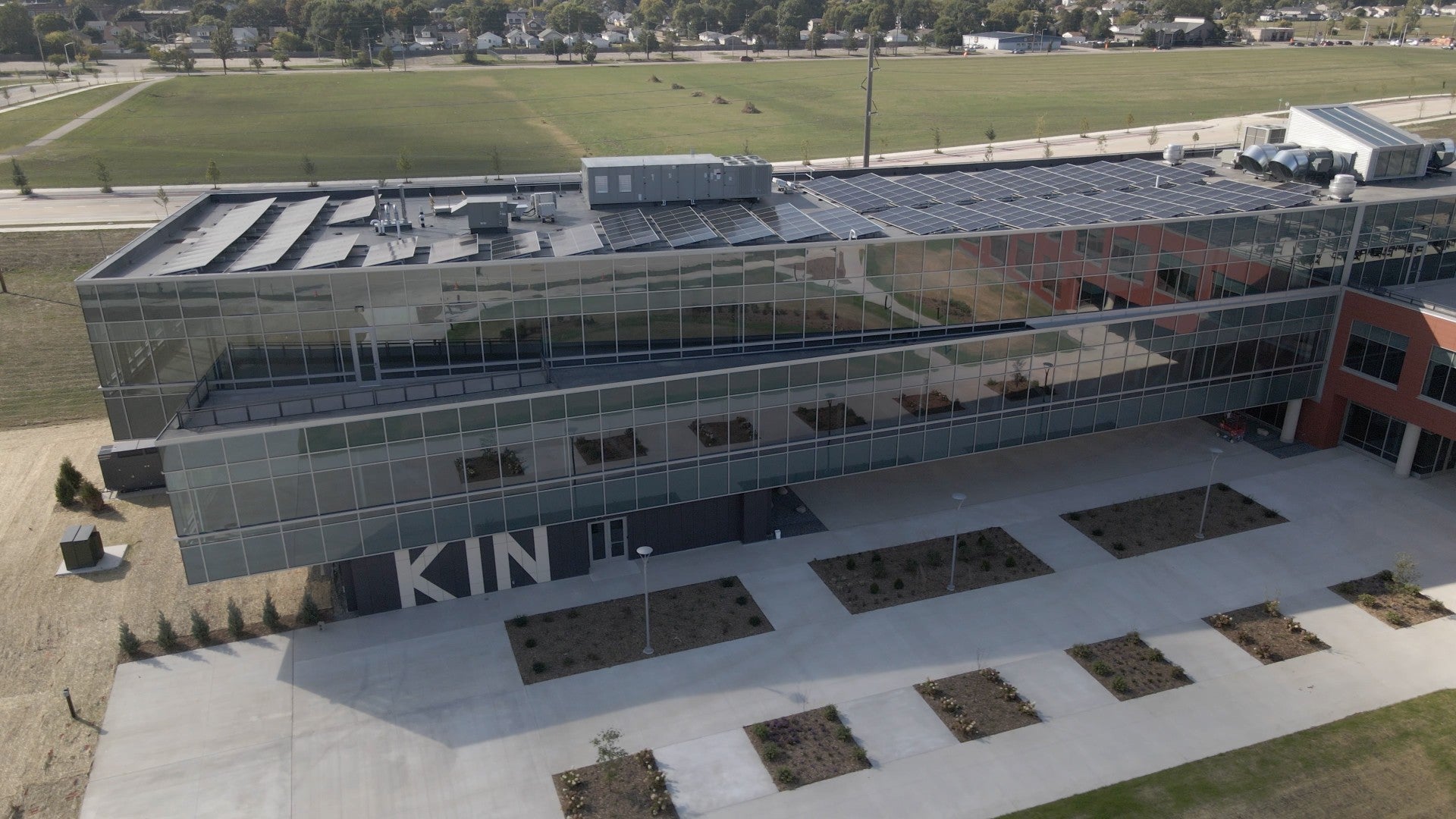

TitletownTech is a venture capital firm that launched in 2019 through a partnership between the Green Bay Packers and Microsoft. Its investment targets go across industries including sports, digital health, supply chain technology, and agriculture, water and environment.

TitletownTech eyes second portfolio

In its first investment fund, TitletownTech invested $25 million in 23 startups — three of which relocated to Green Bay from other states, according to Dickman, the firm’s managing director. Those firms are ChemDirect from Los Angeles, Quantum Radius from Denver and Oculogica from New York.

“That gave them a better chance of success here in our region than it would have been if they stayed where they were,” Dickman said.

While TitletownTech plans to continue monitoring the companies it invested in during its first fund, the firm is targeting $80 million in investments in its second fund.

While the second fund is still in the early stages, Dickman said TitletownTech has already made four investments.

“What we really have tried to do as we’ve moved from fund one to fund two is meet the market opportunity where we see it,” he said. “I think we feel good about the opportunities that are developing within our region and (we) are interested in creating impact within our region.”

Wisconsin Public Radio, © Copyright 2026, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.