Medical device manufacturers, including many based in Wisconsin, want a new devices tax that’s part of the Affordable Care Act repealed. Symbolic votes indicate there’s Congressional support for a repeal, but the support is counterbalanced by how much money the tax generates and what it pays for.

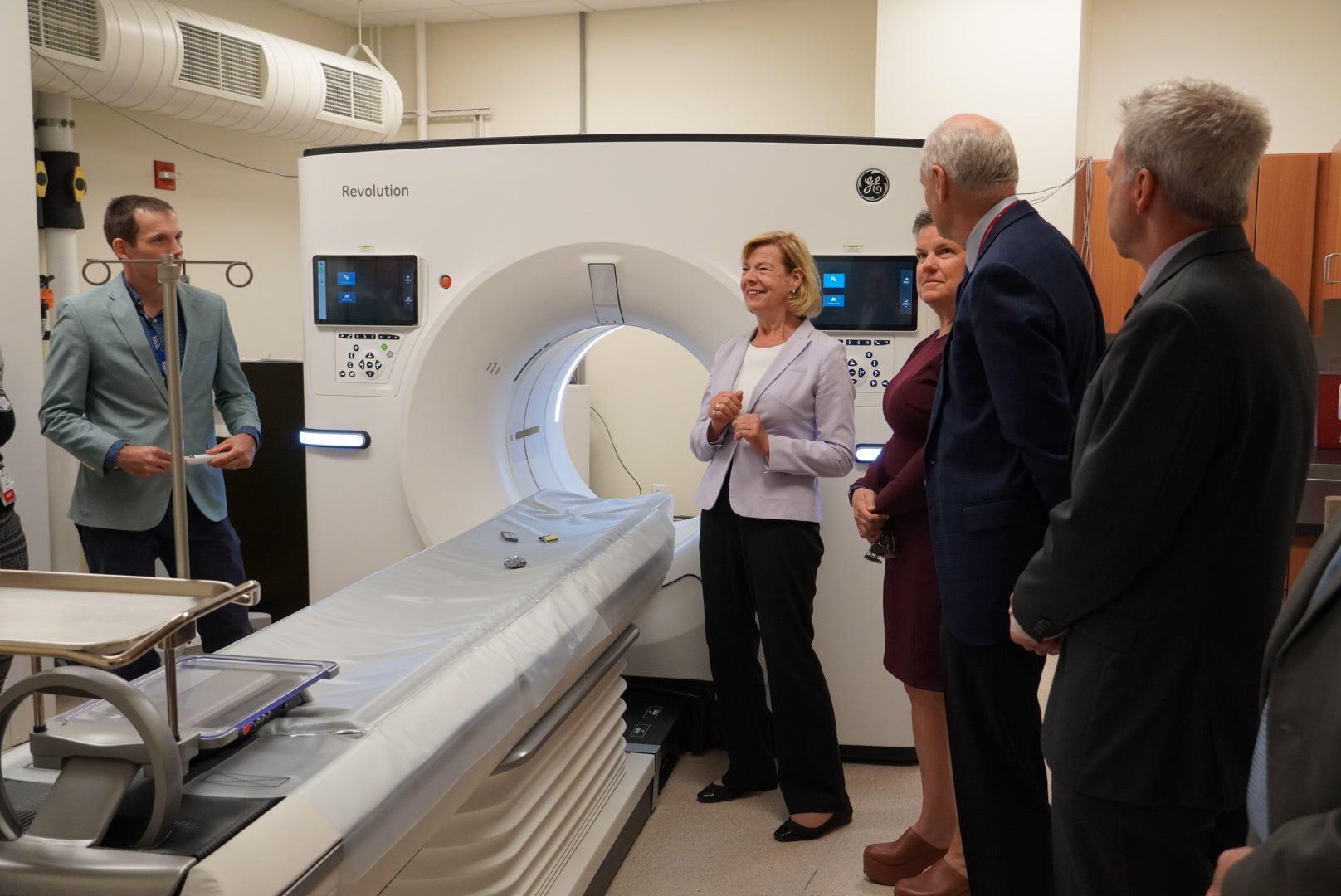

One of ways the ACA is funded is through a tax on medical devices: everything from advanced imaging technology to wheelchairs. Wisconsin is among the top ten producers of medical devices in the country; the Wisconsin trade group for biotech companies, BioForward, estimates 200 companies would be affected by the new tax.That includes big ones, like GE Healthcare, but also smaller ones, says BioForward’s Executive Director Bryon Renk: “The problem with the tax is that it’s based on revenue, and not profitability,” he said. “Most of the medical device companies are small.”

Critics of the tax have predicted companies will lay off workers or move production overseas. The Center on Budget and Policy Priorities, however, notes the tax applies to imported as well as domestically produced devices.

Stay informed on the latest news

Sign up for WPR’s email newsletter.

Supporters and critics do agree on one thing: perhaps the most persuasive argument for keeping the tax may be how much it’s expected to generate for health reform. “It’s about a $30 billion chunk for the health care act. Where do they make up that up if they repeal it?” asked Renk. “That’s the problem with that whole discussion.”

Repeal of the tax is opposed by key Senate Democrats, like Majority Leader Harry Reid (D-Nev).The Obama administration has defended the tax on medical devices, saying manufacturers stand to benefit because health reform will result in more insured customers who can use their products.

Wisconsin Public Radio, © Copyright 2024, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.